Individuals & Families

Here’s how partnering with Integris can help you pursue your goals with confidence:

Protect & Grow Your Wealth

Your relationship is tailored to your needs, but here is a snapshot of our services

Investment Management

Grounded in Modern Portfolio Theory, our portfolios are built using best‐in‐class investments, are designed specifically to fulfill your goals, and are rigorously monitored.

Read MoreInvestment Management

Integral to our investment management is that we are a fiduciary, are fee-only, and are 100% independent. This means we are required to do what is in your best interest, and we have zero conflicts of interest with regard to choosing one investment over another. With that foundation, we are able to focus entirely on true portfolio management, our core tenets of which include:

Focus On What We Can Control:

Investing is full of unknowns. We devote our time and attention to what we know we can control such as the right asset allocation. You won’t hear us trying to time or predict the market, because ultimately those are simply guesses about aspects not in anyone’s control.

Long-Term:

Short-term goals normally warrant holding cash. Long-term goals require long-term investing. Ebbs and flows of the market are normal and can only be successfully and consistently navigated by remaining steadfast to long-term goals and strategies.

Team:

We manage money as a team. Our investment philosophy is set by our Investment Committee to ensure a collection of experienced minds are governing our portfolio management. Our portfolio monitoring and trading is centralized in our investment group to ensure discipline and consistency. And our advisory group collaborates with both to ensure that our portfolio management is applied optimally to your specific circumstance.

Goals:

Your goals are all that matter. We seek an acute understanding of what you are looking to accomplish with your money so that we can build a portfolio laser-focused on achieving your goals.

Risk Profile:

This is not just what you are comfortable with, but is also an analytical process to determine the risk necessary to obtain the returns needed to achieve your stated goals.

Asset Allocation:

Studies show that as much as 90% of your portfolio’s return is driven by your asset allocation. This decision is paramount and is strictly determined by your goals and risk profile.

Implementation:

The right asset allocation is not enough. How your asset allocation is implemented matters, which we accomplish through Diversification, Asset Location, and Investment Selection:

Diversification:

Diversification is considered by many to be the only free-lunch in investing. Done properly, it reduces risk without reducing return. Further, Modern Portfolio Theory demonstrates that the risk and return of investments in combination is what matters, not the risk and return of each investment in isolation.

Asset Location:

Various accounts that are earmarked for the same goals are best managed as one portfolio and one strategy for reduced trading costs. Further, if your portfolio has any combination of taxable, tax-deferred, or tax-free accounts, being purposeful about which investments go in which accounts leads to greater tax efficiency. Each account ends up looking different, but the whole is optimized and right on target.

Investment Selection:

Remaining disciplined with focusing on what we can control, as opposed to what we can’t, we utilize exchange traded funds and mutual funds for diversification, and seek funds that have low fees, low cash allocations, are very liquid and marketable, and demonstrate style consistency so we are always confident in knowing what we own.

Spending Pattern:

Critical to long-term success, we help define a sustainable portfolio draw, and for portfolios with any combination of taxable, tax-deferred, or tax-free accounts, we guide the most advantageous order by which to draw.

Monitoring:

Ensuring a portfolio remains consistent with its stated strategy and purpose is critical. Though trading should be fairly infrequent, our daily monitoring ensures a portfolio does not veer off course, and seizes opportunities for lax loss harvesting in taxable accounts.

Insurance Evaluation

A financial plan is necessary, but insufficient. Ensuring nothing derails your financial plan completes the picture. Integris reviews your insurance so you can sleep well knowing you have protected yourself against unnecessary risks.

Debt Planning

Leverage can be a best friend or worst enemy. Integris assesses your loans to ensure they have favorable terms and are helping you toward your goals.

Legacy Planning

Integris summarizes your estate plan so that it is easily understood, and to help you ensure that it remains consistent with your lifetime and legacy wishes.

Tax Planning

Knowing that it is not what you make, but rather, what you keep that matters, Integris builds tax efficient portfolios, and reviews your entire circumstance to identify any tax issues or opportunities.

Real Estate Evaluation

Real estate is a part of everyone’s life. Integris can advise on primary and vacation homes, as well as residential and commercial investment properties so that you can be confident in how your assets are deployed.

Financial Sustainability

Your financial security is paramount. We inventory your lifetime income streams and expenses, and then forecast the success rate of achieving your goals so you can make smart choices about life’s biggest decisions.

Philanthropic Planning

We help you find the solutions that allow you to enjoy tax benefits while maximizing your impact on the people and causes you care most about.

Employee Benefits Advice

Today, benefit programs represent a significant portion of an overall employment package, but can be overwhelming. We review and advise you on your options, whether those relate to pensions, 401(k)s, or life insurance so that you get the most bang for your buck during your career.

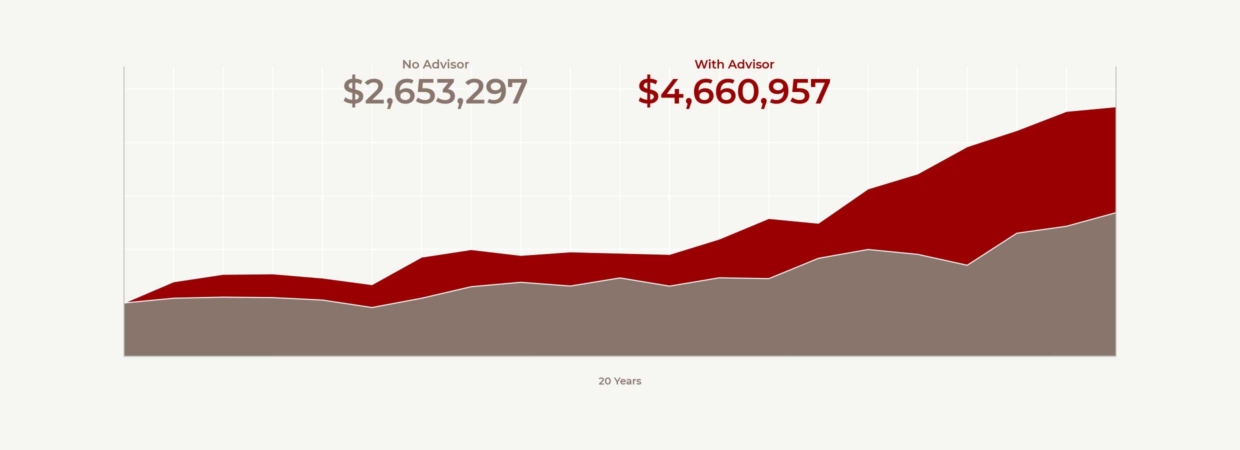

The Value of an Advisor

Our aim is to improve your chances of achieving your goals and dreams

Based on our analysis, advisors can potentially add about 3% in net returns by using the Vanguard Advisor's Alpha framework.