Investing During an Election Year

We’re less than three months away from a major election. While partisanship has long been a fact of political life in the United States, the assassination attempt on former President Donald Trump and President Joe Biden’s decision to drop his bid for reelection has introduced another level of uncertainty to an already turbulent election year. Against the backdrop of current events and a general election fast approaching, many investors might be wondering about the interplay between politics and portfolios.

Whichever administration takes charge next year, they (with the help of Congress) will face the sunset of the Tax Cuts and Jobs Act. Their actions, or lack thereof, will impact how much families and businesses pay in taxes, whether or not there will be cuts to Social Security and Medicare, and how government spending should be handled. There is a lot at stake for the country on both sides of the political aisle, so investors are inclined to draw a direct connection between the outcome of the election and their investment performance.

We cannot predict the outcome of the election, nor can we predict how the markets will react. So, what should we do amidst all of this uncertainty? We’ll share three points for you to consider below, before providing our suggestions.

Presidents Don’t Have That Much Influence Over Markets

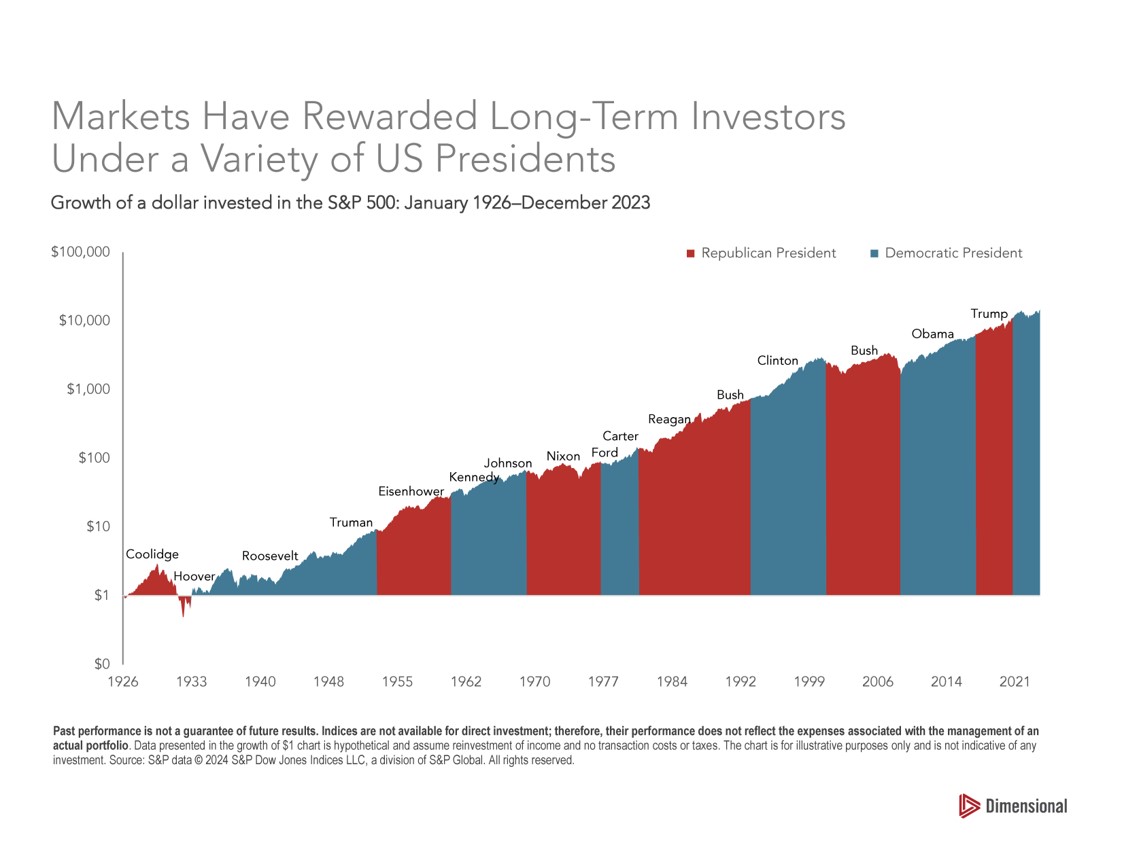

Historically, politics have had very little impact on the markets. A look back into history shows us the stock market has consistently rewarded long-term investors regardless of which party is in the White House or which party controls Congress. The graph below shows the S&P 500’s behavior during various presidential terms, and you’d be hard pressed to draw any conclusions about a president’s political party and market performance.

More importantly, the average return for most presidential terms, whether Republican or Democrat, were mainly positive. Even after periods of shocking political controversy such as Kennedy’s assassination, Nixon’s Watergate scandal, or the Clinton-Lewinsky scandal, the markets kept growing.

Time in the Market Matters More than Timing the Market

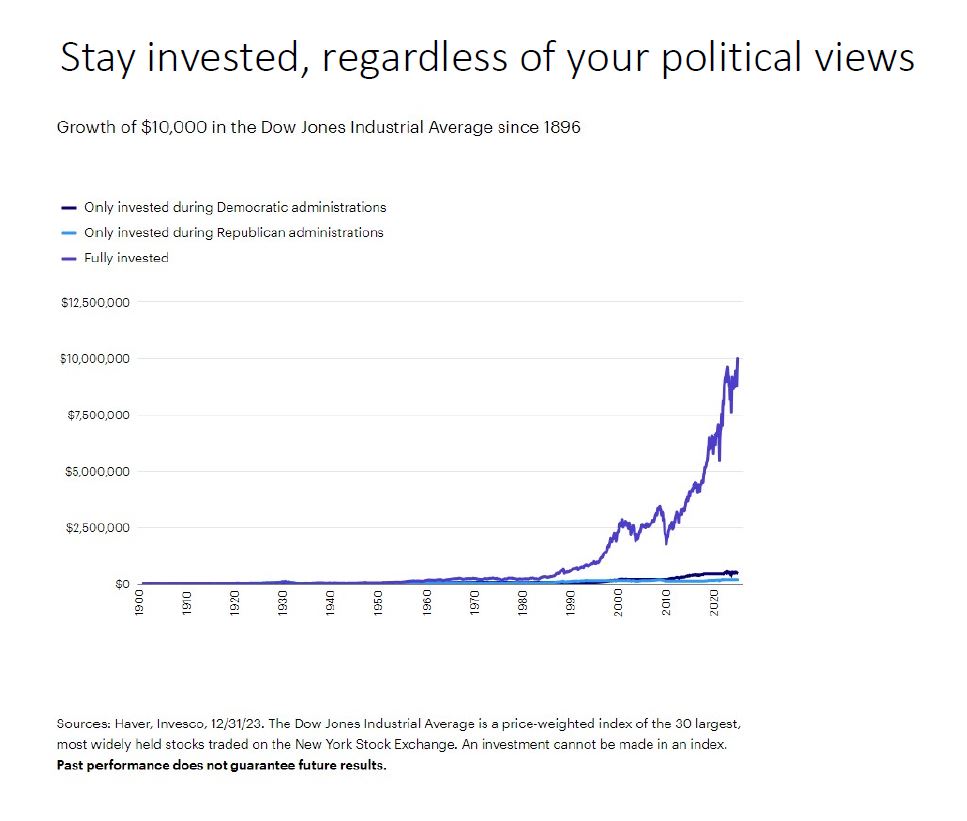

Presidential campaigns have a tendency to magnify the country’s largest problems and draw attention to pessimistic messages. While the instant information economy has uplifted our lives in so many useful ways, it also locks us in an echo chamber that can distort our understanding of the economy and markets. Let’s say we only invest when our preferred political party is in power, because we feel that disaster will strike if they lose. The chart below compares the growth of $10,000 in three scenarios:

- Investors who only invested during Democratic administrations

- Investors who only invested during Republican administrations

- Investors who remained fully invested throughout.

This chart powerfully demonstrates that investors who stayed fully invested throughout various presidential terms were far more successful than investors who only invested according to their party preference. It’s a big gap if you’re only investing when one party is in power. The current election cycle may be characterized by unprecedented challenges, but markets are resilient. For most investors, time in the market will be a much more powerful strategy than timing the market.

Volatility Works Both Ways

An analysis1 of a $10,000 investment tracking the S&P 500 for the last 20 years (January 1, 2004 – December 29, 2023) demonstrates that simply missing out on the 10 best days in the market would have cut your investment return nearly in half! Moreover, that same study showed 7 of the 10 best days occurred within two weeks of the 10 worst days. This means investors who bailed out as the markets went down would have likely missed the best day of the market shortly thereafter.

Final thoughts

Three months is a long time in politics. Political favor can swing wildly between now and November 5. The headlines from the election news cycle often distracts us from thinking clearly about our investment choices. So what should we do when it feels like the ground is shifting beneath our feet? Oddly enough, we can probably rely on the same advice given when the earth is actually shifting under our feet during an earthquake. We should have a plan in advance, and we should stick to the plan regardless of our emotional state at the time. During an actual earthquake, we can feel scared, while still knowing to find the nearest table or doorframe to hide under.

Elections are important. Markets react to important events. There are other important events in the world. All three statements are true. So, making decisions based on one important event among many can prove detrimental to your long-term financial picture. If we consider the data surrounding markets and elections, history tells us that regardless of whether a Democrat or a Republican occupies the White House, the best plan is to just remain invested.

The information provided herein is for educational purposes only, and should not be construed as advice, including, but not limited to tax, legal, insurance, investment, or retirement advice. For your specific planning needs, please seek the advice of Integris Wealth Management, your tax accountant, attorney, insurance agent, or other professional as appropriate. Investing involves the risk of loss. 1Slide 47 - https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/retirement-insights/guide-to-retirement-us.pdf