Give More, Give Back, Give Stock

For those who are philanthropically inclined, think twice about writing out a check to your favorite charity. Rather, consider the gift of highly appreciated stock in lieu of cash. For many, this can be a far more tax-efficient method of giving to the organizations you cherish most.

WHY GIVE STOCK?

When a stock that has appreciated is sold, you are required to pay a tax on the gain. Alternatively, by giving the appreciated stock directly to charity, everybody wins. You do not pay tax on the gains in the stock, because you never sold it, and you still get the tax deduction for the full size of the donation. Furthermore, the charities can immediately sell the shares tax-free and put the money to good use.

So in effect, giving $10,000 of cash or giving $10,000 of stock produces the same donation amount for you and the same value for the charity. The added benefit of avoiding the tax on the stock’s gain, however, is only achieved by giving the stock.

A QUICK EXAMPLE

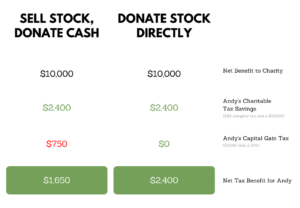

Andy has 100 shares of ABC Company worth $10,000 that were purchased 7 years ago for $5,000. He can either give the 100 shares of ABC to the local charity or sell the shares of ABC and give the $10,000 in cash. What makes the most sense?

THE MATH

By giving the highly appreciated shares of ABC Company to the charity, Andy was able to avoid paying capital gains taxes on the growth of the stock while still giving the same amount of money to the charity. In Andy’s case, this results in $750 of additional tax savings on his tax return.

CONCLUSION

While individual tax situations are always unique, choosing to give highly appreciated stock in lieu of cash to charity can be a powerful giving tool in your financial planning arsenal.

If you are looking to do some strategizing around charitable gifting, please be sure to consult your financial advisor as well as your tax-preparer to map out the best strategy for you!

*Information contained herein is for illustrative and educational purposes only, and should not be considered advice.